Tax Cuts & Jobs Act: How Corporations Are Cashing In Six Months Later

June 2018

Click here to download the full report.

On December 22, 2017, President Trump signed the Tax Cuts and Jobs Act (TCJA) into law. Its most drastic decrees were those impacting corporations, including a 40 percent across-the-board cut in the corporate tax rate and provisions changing how profits earned overseas are taxed. In their push to sell the law to a skeptical public, Republican lawmakers swore that those benefits would “trickle down” to the rest of us through an expansion in business investment, leading to job and wage growth.

Six months in, however, there is little evidence that tax cuts are accelerating either employment or investment growth. Unemployment has been decreasing every year since 2010, and that decline has decelerated slightly since the tax cuts went into effect. Overall economic growth has also slowed in the first quarter since the tax act was passed.

Still, in the weeks following passage of the act, a flurry of companies joined a noisy public relations chorus touting the ways their tax savings would free them to offer pay raises, bonuses, and increased investments in their U.S. workforces. Despite these claims, corporate tax breaks have not resulted in a change in corporate behavior – or at least not where workers, customers, and communities are concerned. In the first quarter of the year, large corporations spent considerably more on stock buybacks to enrich large shareholders than they did on U.S. capital and workforce investment. Plant closings and layoffs have continued at roughly the same pace as prior to the act’s passage, and claims related to direct worker benefits in the form of wage increases and bonuses have been highly misleading.

To understand how corporations are benefiting from the new law and how they are spending their tax cuts, we have taken an industry-specific approach, focusing on market leaders across nine major sectors: Airlines, Automotive, Banks, Communications, Fast Food, Oil & Gas, Pharma, Retail, and Technology. These industries both represent the U.S. economy and were among the sectors most highly impacted by changes under the new tax law. Under this approach, we examined 40 companies to assess their tax act-related claims and the reality behind those claims.

Under the new corporate rate, 33 companies examined in this report had tax cuts totaling $11 billion in the first quarter of 2018 alone. The tax act made cuts to the corporate rate permanent, and companies will continue to see similar results in each subsequent quarter. Over half of these companies paid less than the new 21 percent statutory rate in the most recent quarter. Banks, tech, communications, and other companies saw double-digit drops in their effective tax rates, resulting in huge cuts over the same quarter last year. Half of the companies we examined also recorded a one-time gain in 2017 from the decrease in their tax liabilities, totaling $81 billion. Some of the tax act’s biggest winners realized billions in benefits from having put off paying their taxes in the past.

Many of these corporations were among the hundreds that released statements praising the new law and vowing to share their tax windfalls with their employees and communities. Focusing on seven main aspects of corporations’ claims or behaviors, we found that the reality looks different:

- The wage bumps announced by corporations in response to the tax plan are in fact largely a response to outside forces – such as local minimum wage increases – and some were underway well before passage of the law.

-

Walmart says it will raise its base wage to $11/hour, at an annual cost of $300 million – about 10 percent of the company’s yearly advertising budget. Almost 250,000 Walmart employees – or over 16 percent of the company’s workforce – work in states where the minimum wage is already $11 or will be going to that rate within the next year. The company is responding to a tighter market for low-wage workers, and competitors had already raised their wages to this level prior to the tax act. Further, as Walmart touts the modest increase, it has been cited as the U.S. corporation with the most wage theft penalties for violations such as forcing employees to work off the clock or failing to pay required overtime.

-

-

The one-time cash bonuses that blanketed news coverage immediately after the law was passed actually represent an insignificant investment from corporations, make a negligible impact on the economy, and pale in comparison to lavish executive pay. The 10 companies in our study that awarded one-time bonuses, averaging $1,100 per worker, gave their CEOs 2017 cash performance bonuses averaging $3.2 million.

-

Comcast said it would give $1,000 one-time bonuses to 100,000 employees – in contrast to the $9.1 million bonus to its CEO Brian Roberts in 2017. Including Roberts, Comcast’s named executives made $26.4 million in cash bonuses last year – over a quarter of the $100 million spent on bonuses for the other employees.

-

-

Companies celebrated announcements of U.S. investment or hiring plans that were in fact completely in line with past spending and growth levels.

-

In January 2018, Exxon Mobil CEO Darren Woods said the company would invest $50 billion over the next five years as a result of the company’s strong performance “enhanced by the historic tax reform recently signed into law.” A spokesperson later clarified that the company had already announced $15 billion of that spending prior to the tax act. Regardless, its plans are more attributable to rising oil prices than to Trump’s tax cut. Before the 2014-2016 oil price drop, Exxon spent about $50 billion in U.S. capital expenditures between 2010 and 2014. With oil prices now back at their highest level since the end of 2014, Exxon had already begun to boost overall capital expenditures, which rose 20 percent from 2016 to 2017.

-

-

Despite claims that the corporate tax cut would add “rocket fuel” to the economy, plant closings and layoffs have continued at roughly the same pace as prior to the act’s passage.

-

Over half of the companies in our study have announced layoffs in the six months since the tax act passed. The three communications companies examined in this report have announced combined layoffs of over 5,000 workers. In early 2018, it was reported that Microsoft and Amazon will lay off hundreds of corporate employees. And hours after it trumpeted its tax cut bonuses, Walmart announced that it was closing 63 Sam’s Club stores across the country, eliminating approximately 10,000 jobs.

-

-

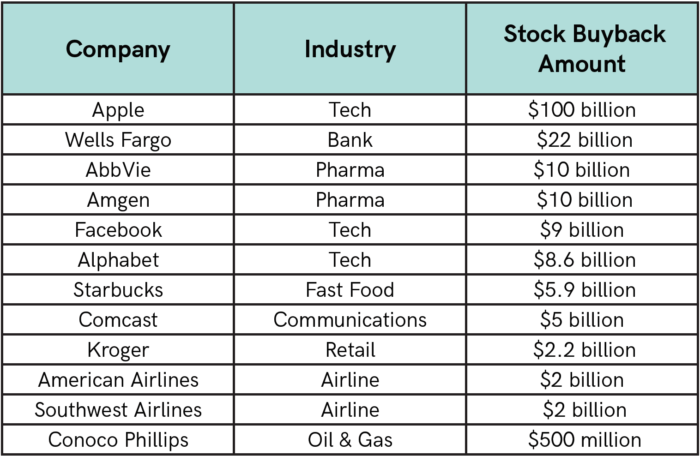

Companies have massively increased their spending on stock buybacks. Since the passage of the tax act, twelve of the companies in our study have announced buybacks totaling $177 billion. Overall, U.S. companies are currently on pace to buy back $1 trillion in shares by the end of the year. In the first quarter of 2018, S&P 500 companies spent $178 billion on buybacks, compared to $166 billion on capital expenditures, a figure that includes total – not just U.S. – investment.

- Corporations have spent their tax windfall to enlarge their market share through new acquisitions or foreign investment, rather than organic growth. In 2018, Microsoft announced it would acquire GitHub for $7.5 billion. In June, Comcast announced a $65 billion offer to compete with Disney’s $52 billion bid to acquire 21 Century Fox’s entertainment businesses. Walmart spent $16 billion on a majority stake in an Indian e-commerce company, a move that Amazon countered by upping its investment in the country. This type of M&A activity does little for U.S. workers.

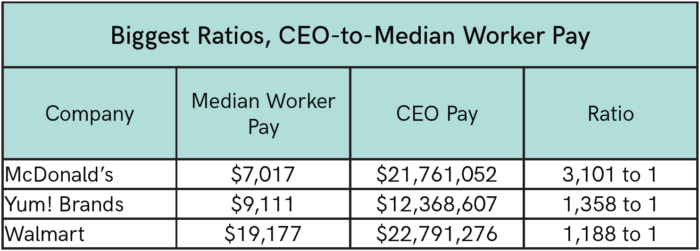

- CEO pay continues to climb. The average pay for CEOs at the companies in our study was $18 million in 2017, with compensation around $30 million at Comcast, Johnson & Johnson, and AT&T. (These packages often don’t even include the value of stock vested during the year, such as over $89 million’s worth to Apple CEO Tim Cook). We also found CEO-to-median worker pay ratios as high as thousands to one.

The new tax law has handed corporations billions in tax cuts every year. Supporters of the tax act said those savings would be passed down to workers and communities in the form of increased investment, higher wages, and new jobs. We see little evidence of these claims in the economic data, nor in the actions of individual corporations. U.S. companies continue with business as usual – with an enhanced ability to enrich their shareholders, but little inclination to create an economy that works for us all.